Protecting your wealth and planning for your future is critical to peace of mind. Premier provides multiple solutions to support your finances. From life and disability insurance to a 401(k) plan and tax-free spending accounts to pay for out-of-pocket medical and commuter transportation costs, we've got you covered.

FINANCIAL HEALTH

Life Insurance (Basic and Voluntary)

Basic Life Insurance (Employer Paid)

Premier Employer Paid Life plan, offered through UnitedHealthcare, provides you with security and peace of mind by knowing that you will be protected in case of disability and your family will be provided a financial cushion in the event of your death. Premier pays 100% of the premium.

Optional Life Insurance (Employee Paid)

You have the option to supplement your basic life insurance with Optional Term Life Insurance.

Coverage is available in increments of $10,000, up to a maximum of $500,000. You can add coverage for your spouse in increments of $5,000 up to a maximum of $250,000.

Disability Insurance (Short and Long Term)

Short Term Disability

You can feel confident knowing that if you experience an illness or injury that prevents you from working, you may receive benefits to help you replace lost income.

The maximum benefit period is 12 weeks, during which time you can receive 60% of your weekly earnings to a maximum weekly benefit of $2,500.

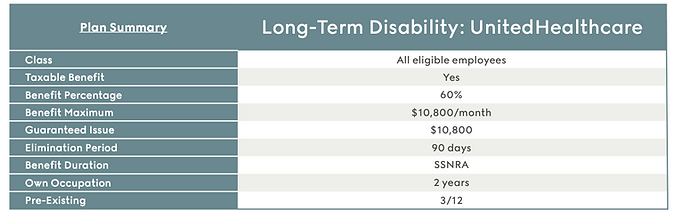

Long Term Disability

If you face a serious disability that prevents you from working over a long period of time, Long Term Disability provides income to cover your finances.

The maximum benefit period is to normal Social Social Security age, during which time you can receive 60% of your weekly earnings to a maximum monthly benefit of $10,800.

401(k) Plan

Eligibility

Employees ages 21 and older with 3 months of service are eligible to enroll in the plan. the following classes of employees are not eligible to enroll in the plan:

-

Employees covered by a collective bargaining agreement

-

Non-resident aliens

-

Leased and temporary employees

-

Independent contractors

Additional Notices Available

-

-

Participant Disclosure Document: fees associated with your Plan account

-

Qualified Default Investment Alternative (QDIA) Notice and Fund Information Sheet: details on the plan’s default investment options

-

Fidelity HardCard and Flyer for NetBenefits® - New user registration instructions

-

Invest some of what you earn today for what you plan to accomplish tomorrow.

Take a look and see what a difference enrolling in your workplace savings plan could make in helping you achieve your goals.

-

Tax Savings – Once you make an election to defer some of your salary into the plan, your pre-tax contributions are deducted from your pay before income taxes are taken out. This means that you can actually lower the amount of current income taxes you pay each period. It could mean more money in your take-home pay versus saving money in a taxable account. Also, you pay no taxes on any earnings until you withdraw them from your account, generally at retirement, enabling you to keep more of your money working for you now.

-

Maximize your contribution – Visit the IRS website for current annual contribution limits to ensure you’re utilizing your retirement benefits to the fullest. IRS Contribution Limits

-

Convenience – Your contributions are automatically deducted regularly from your paycheck.

-

Portability – You can roll over eligible savings from a previous employer into this Plan. You can also take your plan vested account balance with you if you leave the company.

-

Investment Flexibility – You have the flexibility to select from investment options that range from more conservative to more aggressive.

-

Rollovers – The plan will accept amounts directly rolled over from the prior plan to this plan including Roth Deferrals and Nondeductible Employee Contributions if the prior plan was a qualified retirement plan, 403b annuity plan, Traditional IRA or a government 457 plan.

-

Loans – If you need to borrow money, for any reason, you can take a loan from your vested balance. You can borrow 50% of your account balance with a minimum limit of $1,000 and maximum limit of $50,000.

-

Hardship – If you have a financial hardship, you may take a distribution from your deferral contributions and vested amounts from all sub-sources. The types of expenses that qualify for hardship distribution include:

-

Unreimbursed medical expenses for you, your spouse, or your dependents

-

Payment to purchase your principal residence

-

Post-secondary tuition and education-related expenses for you, your spouse, or your dependents

-

Payments to prevent eviction from your principal residence

-

Funeral expenses for your parent, your spouse, or your dependent

-

Payments to repair your principal residence that would qualify for a casualty loss deduction.

-

Flexible Spending Account (FSA)

Premier provides eligible employees the opportunity to enroll in a Medical Flexible Spending Account (FSA) plan, as well as a dependent care plan through Benefit Resource (BRI). Both of these plans offer employees tremendous opportunities to make pre-tax payroll withholdings to pay for qualified medical expenses and qualified dependent care expenses.

Premier also provides a Limited Purpose FSA is a Flexible Spending Account (FSA) that is compatible with a Health Savings Account (HSA). If you’re enrolled in a qualified high-deductible health plan and have an HSA, you can maximize your savings by pairing your HSA with a Limited Purpose Flexible Spending Account (FSA). This pre-tax benefit account lets you take advantage of the savings power of an HSA and a Healthcare FSA simultaneously. A Limited Purpose FSA is referred to as this because it is used to pay for eligible dental and vision care expenses only

2026 CONTRIBUTION LIMIT: MEDICAL FSA

Maximum Annual Limit: $3,400

Maximum Rollover Limit: $660

Please click here for more information on these programs.

Health Reimbursement Account (HRA)

Premier will enroll all employees who have elected the UHC Select Plus 5000 + HRA medical plan into the HRA through BRI. Premier will make an annual contribution toward the HRA in amounts of $2,500 for an individual or $5,000 for employees with dependents. HRA funds are to be used on Co-pays, Rx copays, and medical expenses only. (Not to include dental/vision)

Eligible expenses under the Plan are defined by Internal Revenue Code Section 213(d). However, the plan does exclude the following:

-

Over-the-counter expenses

-

Dental expenses

-

Vision expenses

-

Medical insurance premium.

-

If expenses are eligible under both an HRA and Medical Flexible Spending Account (FSA) sponsored by your employer, your HRA funds will be used first until they are exhausted.

-

Please review the Plan Highlights for additional information.

Health Savings Account (HSA)

Employees enrolling in the PPO HSA 4000 HDHP plan can enroll in a Health Savings Account (HSA). HSAs allow you to save pre-tax dollars to pay for eligible medical, dental and vision expenses.

You can contribute pre-tax funds to your HSA up to the IRS annual limit!

2026 CONTRIBUTION LIMIT: HSA

The IRS maximum HSA contribution for 2026 is $4,400 for individual, $8,750 for family. The catch-up contribution limit for those over age 55 is $1,000.

See IRS Publication 502, “Medical & Dental Expenses,” for a complete list of expenses covered by your HSA.

Commuter Benefits (Transit and Parking)

Premier is proud to offer a commuter benefits program to encourage employees to use public transit or vanpools. These benefits allow you to use pre-tax dollars to pay for public transportation to commute to work or to pay for parking at work. Benefits Resource, Inc. is the vendor.

2026 CONTRIBUTION LIMIT: MASS TRANSIT AND PARKING

Maximum Election: $340 / month

How To Access Your BRI Account

The BRI website provides access 24/7 for account activity, forms, plan documentation, and much more. You can access the website at www.BenefitResource.com and log in as follows:

-

Company code: pstaffing

-

Login ID: Default login ID (typically the Social Security Number [SSN] or Employee ID) is selected and provided by your employer. You may change this upon initial login.

-

Password: Default password is set to your 5-digit home zip code. You will be prompted to change this password upon initial login.

If you have any questions regarding the FSA, HRA, HSA, or Commuter Benefits plans, please feel free to contact BRI's Participant Services Department at 800-473-9595, Monday through Friday, 8 am to 8 pm ET, or email ParticipantServices@BenefitResource.com.

Student Loan Repayment Program

Student Loan Repayment Program (administered by Paidly):

All employees have the opportunity to enroll in our new Student Loan Repayment Program. Anyone who chooses to enroll will receive $50 a month towards paying down their student loans.

Premier Talent Partners will send the contribution to Paidly each month, who will then send it directly to your servicer. You should make your regular monthly payment to stay eligible for that month's contribution. Thanks to these contributions, you will save money on interest and cut time off your loan!

Student Loan Repayment Program (administered by Paidly):

All employees have the opportunity to enroll in our new Student Loan Repayment Program. Anyone who chooses to enroll will receive $50 a month towards paying down their student loans.

Premier Talent Partners will send the contribution to Paidly each month, who will then send it directly to your servicer. You should make your regular monthly payment to stay eligible for that month's contribution. Thanks to these contributions, you will save money on interest and cut time off your loan!

Student Loan Cost Reduction: SoFi

SoFi is a modern finance company providing lending and wealth management services online. They evaluate applicants based on a holistic view of their financial well-being rather than a three-digit score. Whether you are looking to refinance your student loans, buy your dream home, or simply seek advice as you ascend in your career, SoFi provides products and tools to match your ambitions.

-

Convenience: Consolidate all your student loans into a single loan.

-

Flexibility: Choose from a variety of loan terms.

-

No Commitment: No-obligation rate quote

-

$300 Bonus: Receive a $300 welcome bonus.*

*You are eligible to receive the $300 welcome bonus only if you sign up and refinance through the button below.